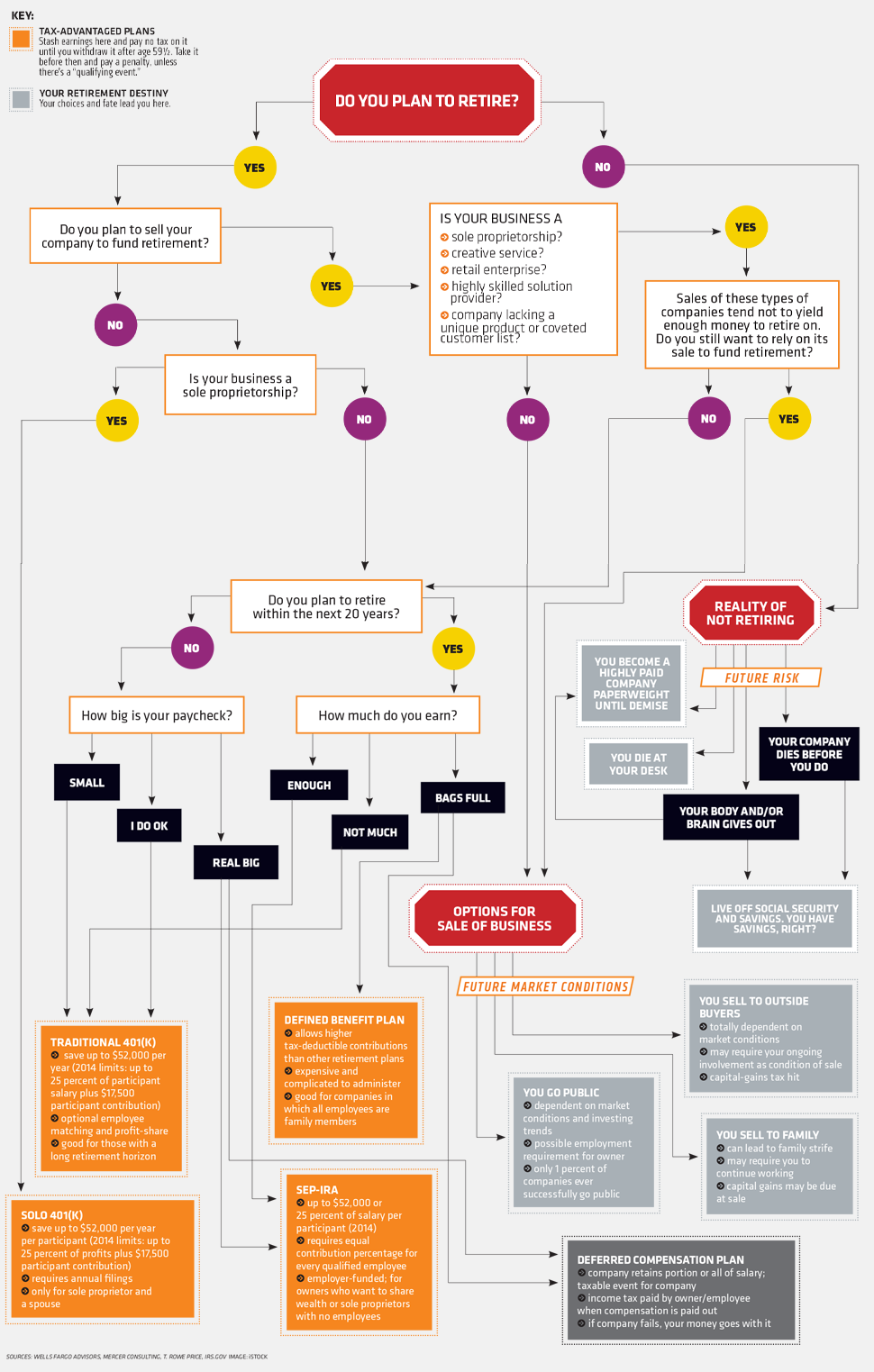

As a small business owner, you are completely responsible for your own retirement planning.

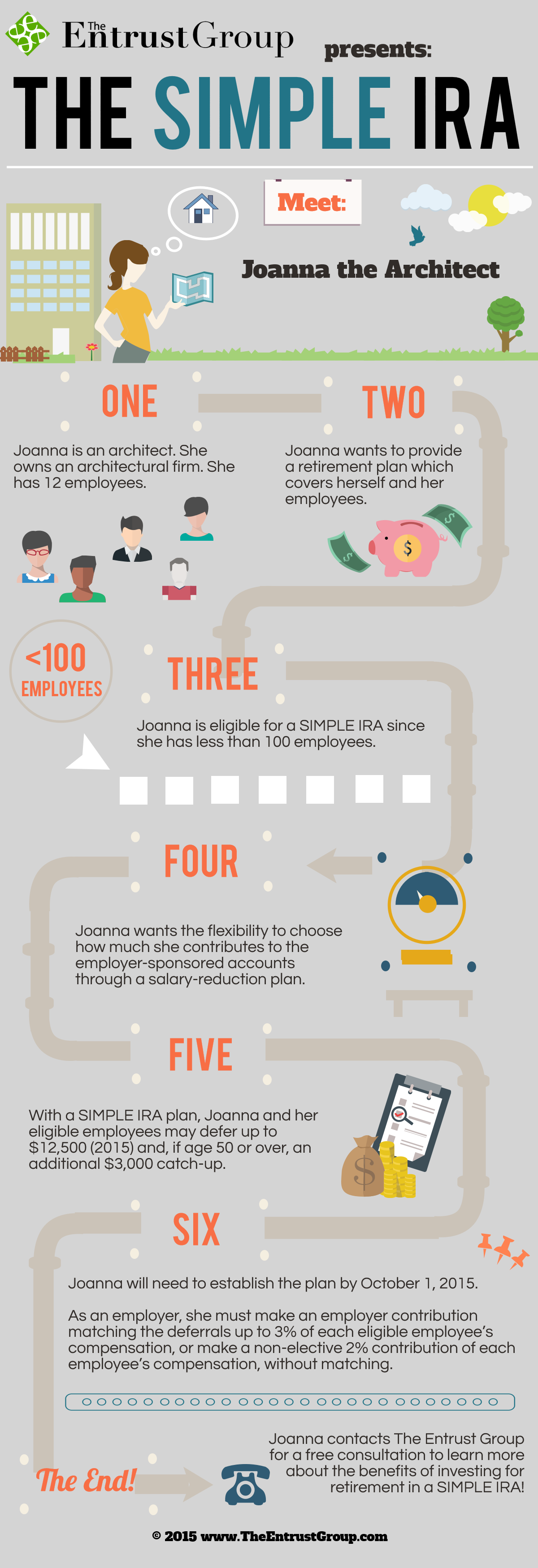

simple ira retirement plan for small business owners simple ira retirement planning how to plan

If you have employees, you may feel responsible for helping them plan for a successful retirement. The considerations and retirement savings plans that work you, as a small business owner, should be. As a small business owner, perhaps youve been wanting to start a retirement plan for some time now.

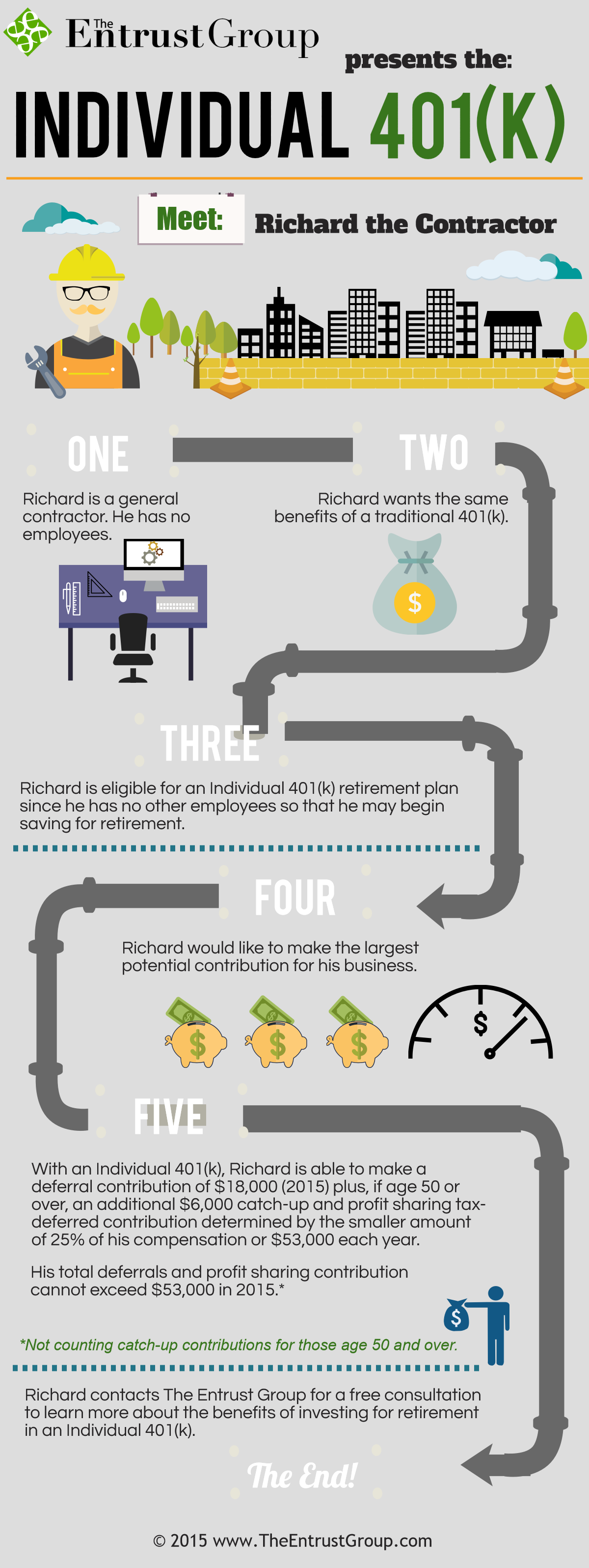

individual 401 k retirement plan for small business owners retirement planning how to plan small business owner

Simple iras are easy to set up and ideally suited as a startup retirement savings plan for small business employers not currently sponsoring a retirement plan. Small employer retirement plans during economic downturns. Some small business retirement plans allow higher savings rates, while others require a lot of paperwork.

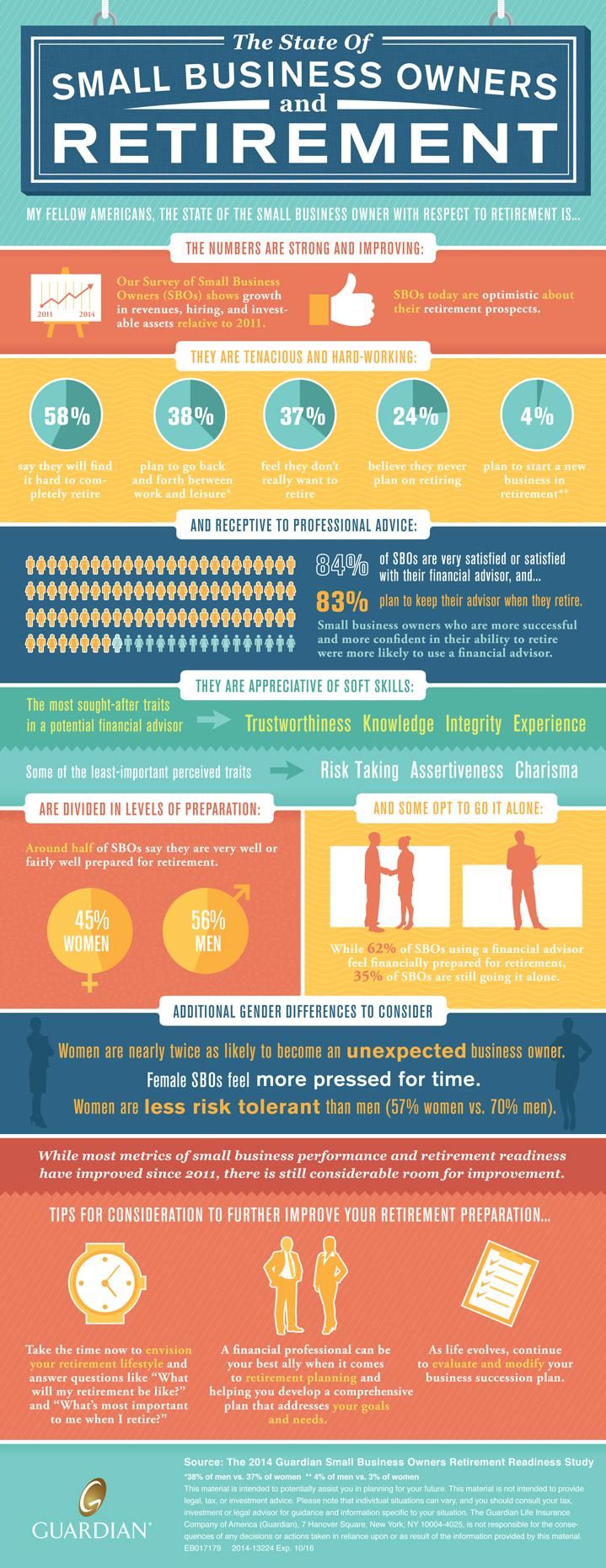

the state of small business owners and retirement as an infographic the retirement plan blog small business owner business owner retirement planning

Find the best one for you. My dad was a small business owner whose engineering and consulting firm provided a solid income for him and supported our family. When he realized none of his four children were going to take over the business, he sold it at age 70.

how small business owners can plan for retirement retirement planning how to plan small business owner

Dad didnt have a retirement savings plan per se. Small business owners have many critical priorities, such as growing their business, making a profit, managing taxes, and attracting and rewarding valuable employees. A small business retirement plan may help them achieve these objectives.

pin on personal finance

Most small business plans are easy to start up. As a business owner, having a comprehensive plan that accounts for yourself, your employees, and your business. Compare small business lenders compare business credit cards funding circle ondeck bluevine business checking chase business checking see » want help planning for retirement?

pin on small business ideas.

6 best retirement plans that will suit your needs at old age retirement planning retirement strategies how to plan.

5 unique self employed retirement plans you need to know about self employed retirement plans retirement planning how to plan.

small business start up small business start up retirement fund business loans.

pin on payroll training.

10 ways to secure future plans for retirement inside your ira investing for retirement retirement planning how to plan.

pin on all about saving money.

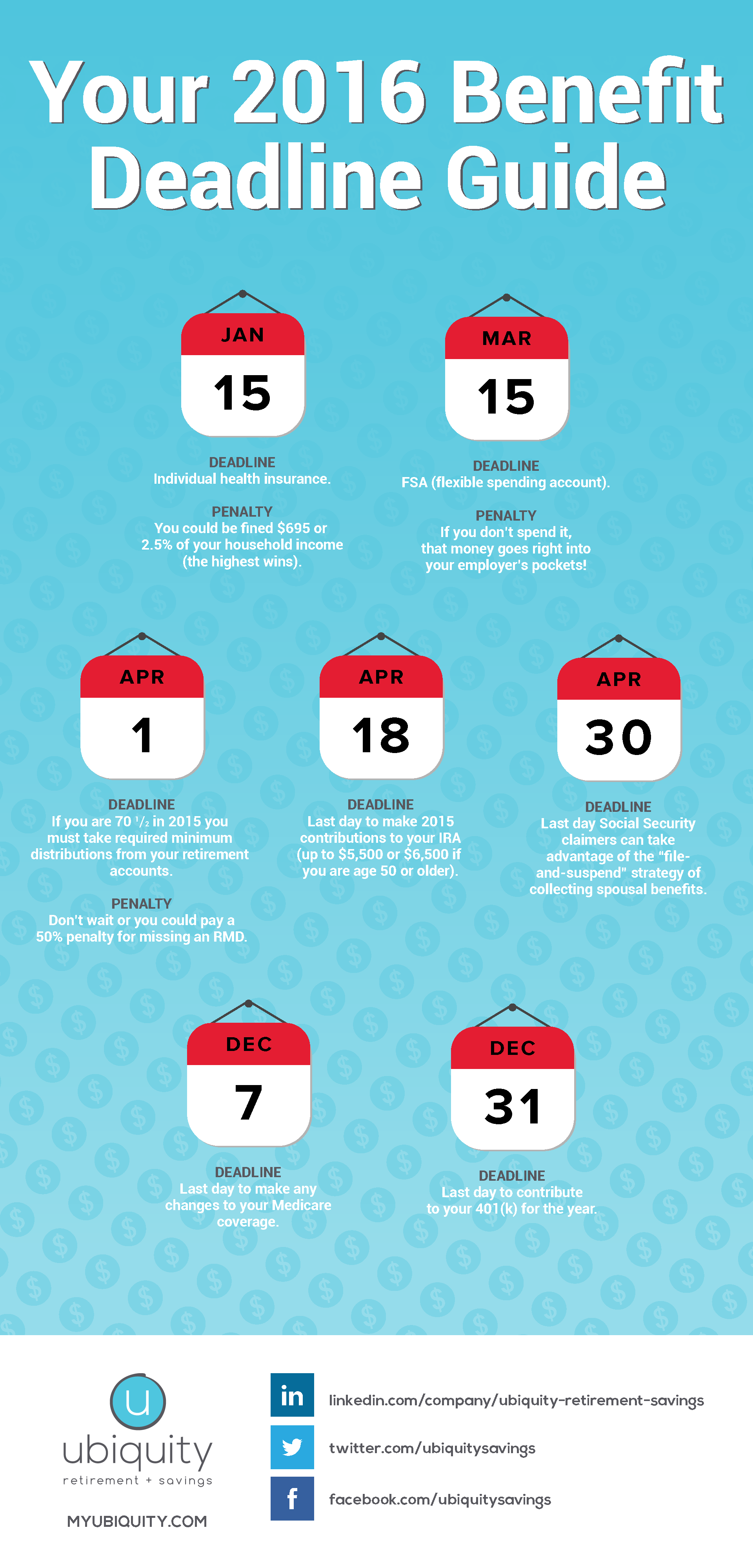

you don t want to miss these benefit deadlines retirement benefits savings strategy retirement planning.

pin on everything personal finance.

knowing what you might face as a small business owner can help make it easier to plan for various scenario small business small business solutions business tax.

finance your business business loans finance business leadership.

how to calculate solo 401 k contribution limits above the canopy how to plan retirement planning investing.

turning your hobby into a business and getting serious about your female entrepreneur goals business podcasts hobby learn business.

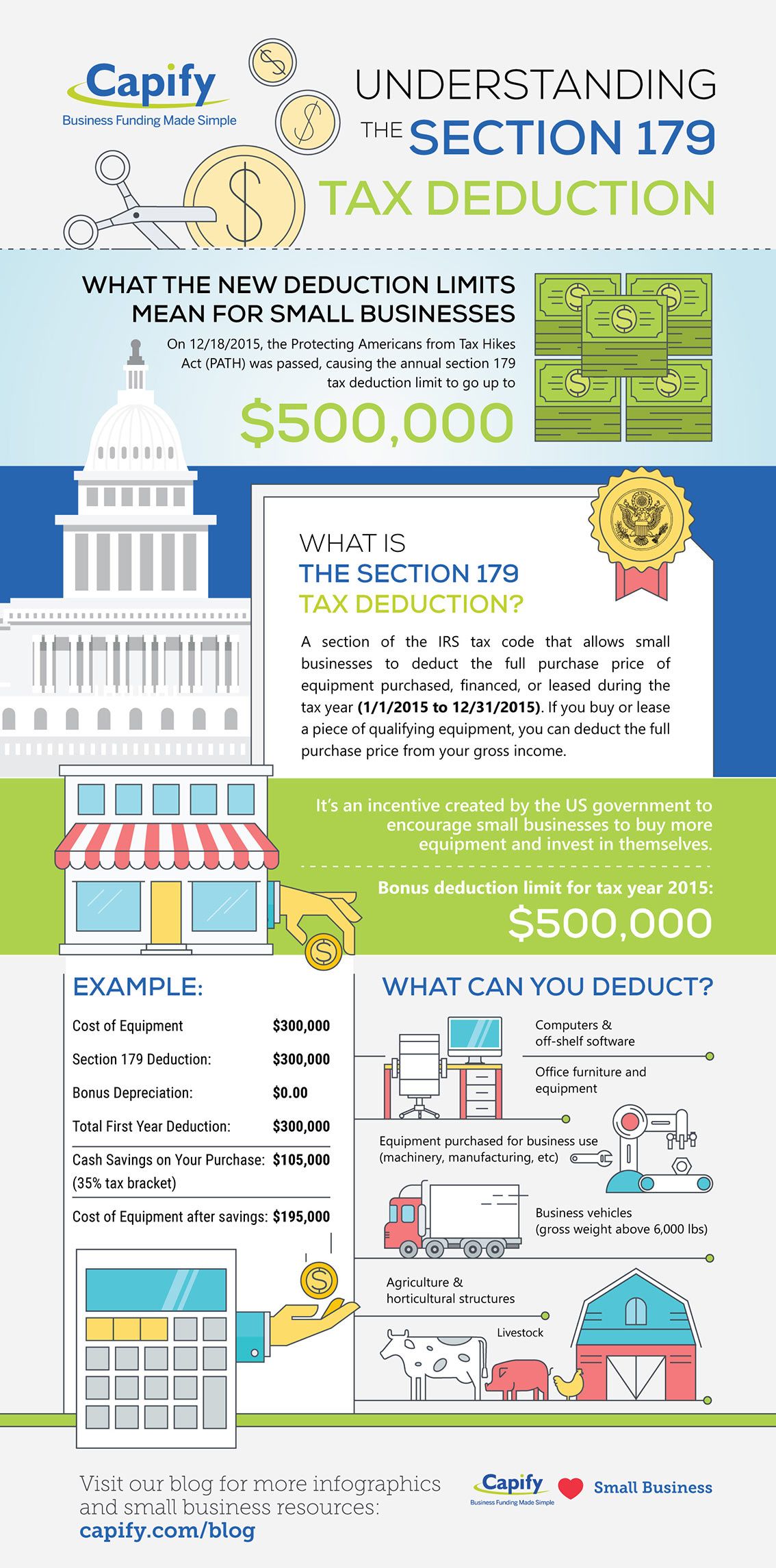

understanding section 179 tax deduction for small business infographic tax deductions small business infographic finance infographic.

500 business owners ideas business owner business small business trends.

the tax reasons to hire your spouse as a business partner and how to do it right business tax tricks saving for retirement.

what to know about retirement plans for chamber staffs izzy west retirement planning money cant buy happiness how to plan.

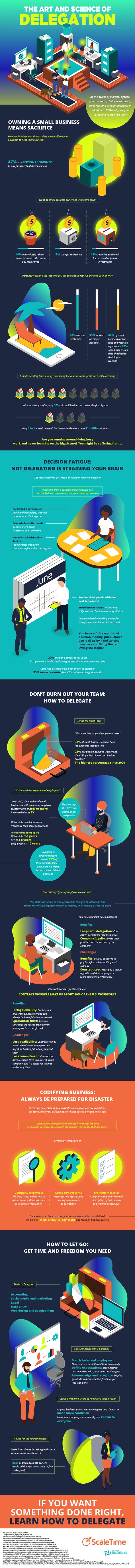

don t let your day to day operations prevent you from planning for your business s financial future in 2020 financial planning small business financial strategies.

pin on your small business.

business flyer apk apk business flyer apkapk business flyer business flyer small business coaching business opportunities.

Check out our retirement planning guide.

Arielle oshea is a nerdwallet authority on. Choosing the right retirement plan for your small business starts with researching all the options available to you and your employees. Zoe financial helps small business owners plan for retirement by connecting them with top financial advisors.

Since every situation is different, zoe financial takes the entirety of a business owners financial life into account during the matching process. Financial advisors in the zoe network are. Retirement plans help business owners save for retirement and attract the most talented employees.

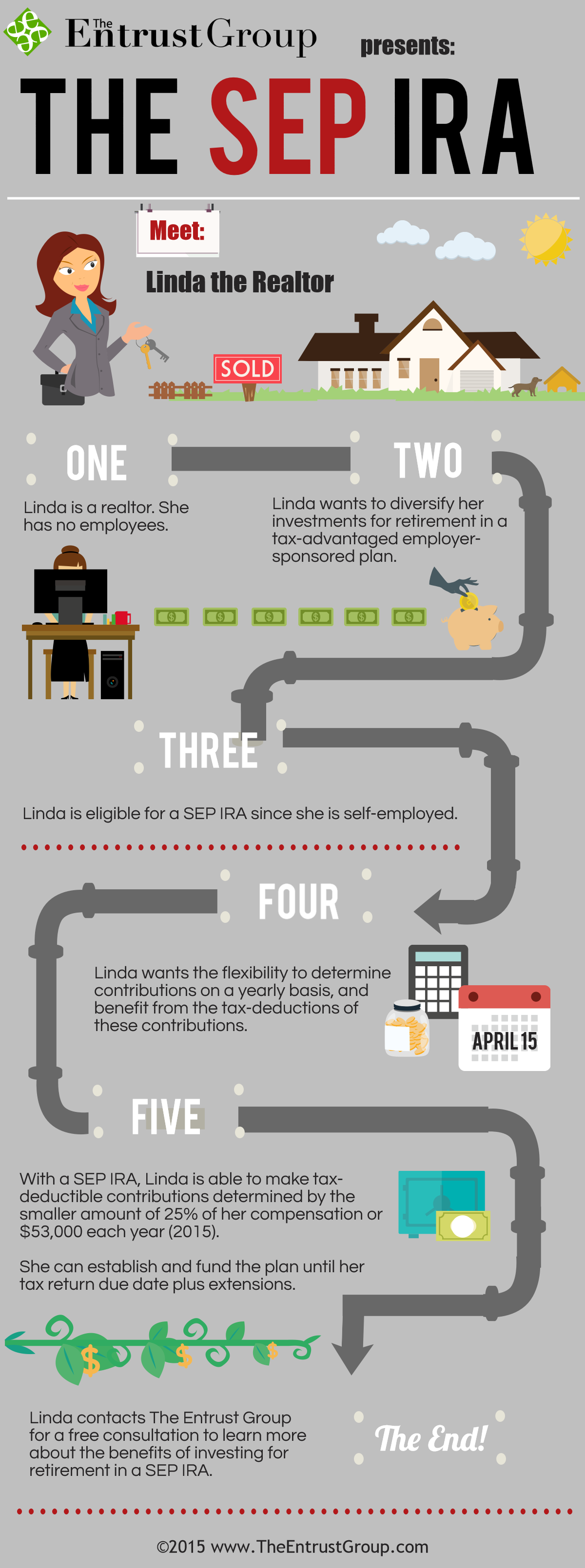

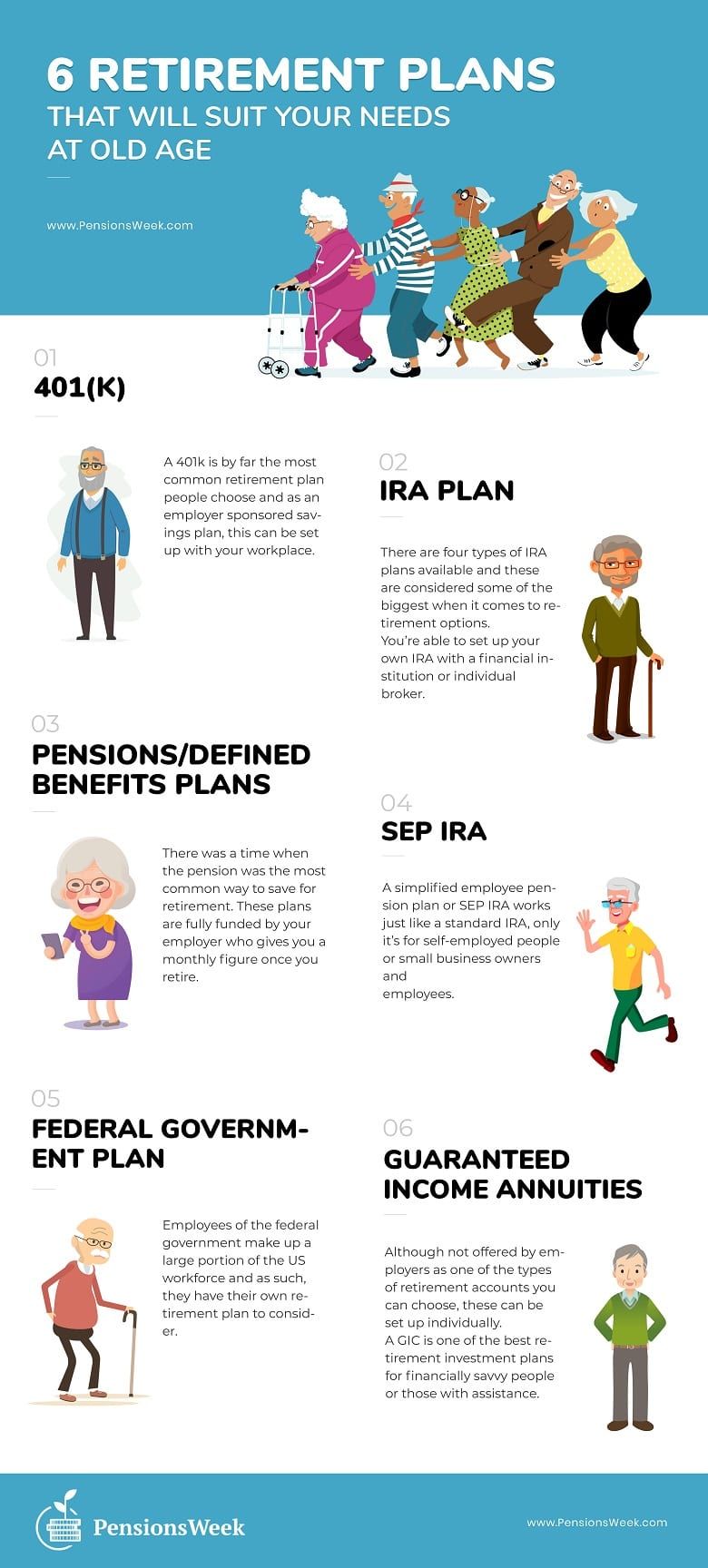

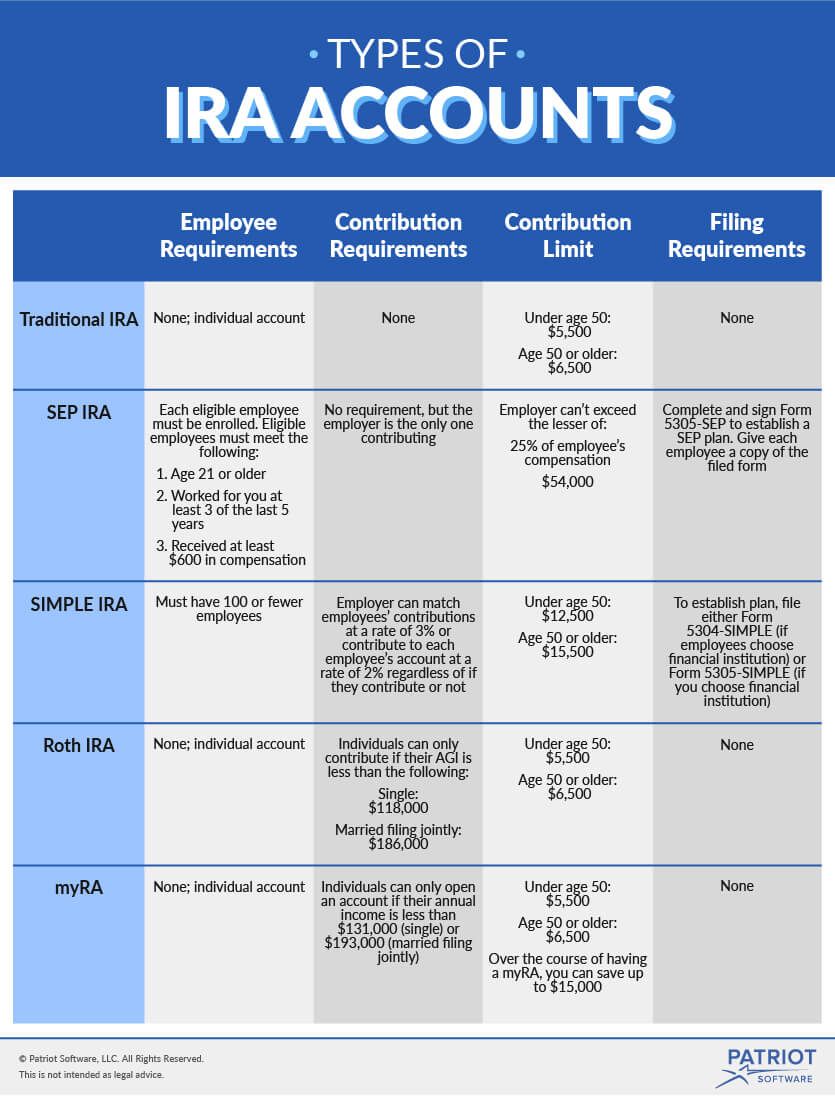

There are 6 main types of small business retirement plans that allow human interests technology allows it to streamline plan administration and generate cost savings for small business owners. This is because the government allows small businesses to set up retirement accounts specifically designed for small business owners. Keogh plans are only for business owners who are sole proprietors, partners in partnerships or limited liability company members.

Retirement plans offer significant tax advantages to small business owners and give them and their employees incentive to save for the future. Several types of retirement plans are available to small businesses, each with its own requirements and restrictions. The same plan is not necessarily ideal.

Small business owners are different from the average hourly employee in a lot of ways. Although small business owners may offer a classic 401(k) for their workers along with other benefits such as insurance and other perks, such a. Finally, small business retirement plans can offer tax advantages to savers.

Small business owners can defer taxes on their retirement savings using these accounts. Individual retirement accounts, or iras, are essential to consider as business owners plan for and create their financial retirement goals. If you are like many small business owners, you may be a little overwhelmed by the choices available to you.